The Chemicals & Plastics industry faces winds of change marked by an ecosystem based on Circular Economy and Sustainability, Digitalization, and the Industry 4.0.

In this setting, we have used Linknovate tool to identify which ones are the emerging trends that will influence the following years of the industry and identified Nanotechnology, Blockchain, and 5G as the ones poised to disrupt the sector in a most pressing way.

For each of those three trends, we have identified and analyzed the top organizations in each field, sub trends, and the most active countries in the field. But, especially, we have analyzed innovation examples that any person in the sector, but mostly those working in innovation, strategy teams, and business development teams should be aware of if they want their companies to maintain as a leader on their sector for the years to come.

1. Nanotechnology

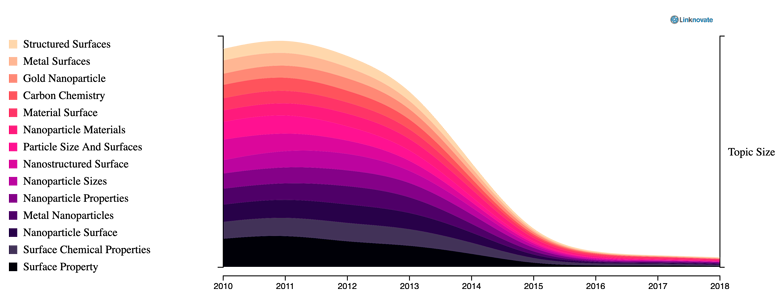

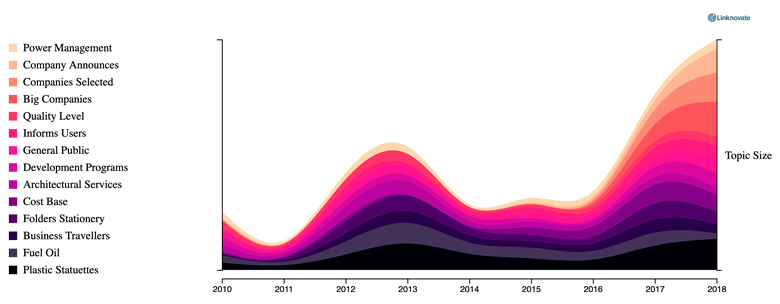

This is a field that does not quite take off, as the temporal evolution graph shows. Besides, we can see how the activity in the field decreases by the years, which probably means that this technology has already surpassed the hype cycle and is currently plateauing.

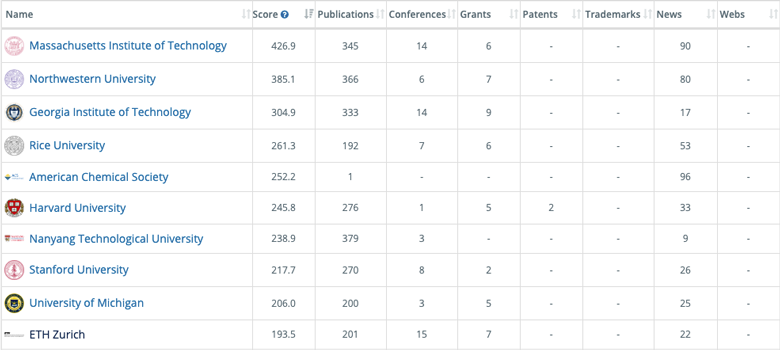

- Key Players in Nanotechnology for the ChemPlast Industry

When looking at the aggregated set of records Linknovate has collected for this topic, we can see that 90% of organizations belong to academia (universities and research labs) and the remaining 10% is comprised of enterprises.

Numbers that are transferred into the top ten organizations ranking, where 8 are universities (7 of them from the United States), one is a society, and the remaining is a Swiss enterprise.

The MIT is the leading organization worldwide working on nanotechnology for the chemical and plastics industry. They have published more than 300 research related papers since 2010, which are mainly focused on exploring carbon nanotubes properties, and in polymer films.

Although Harvard also has extensive related research, what is worth of mention is that they have applied for two patents in the field, which are focused on refillable drug delivery devices. In a more industrial context, Harvard has prototyped droplet microfluidics, and different carbon nanomaterials.

As for Georgia Institute of Technology, since 2010 they have received almost $14M in 9 different grants awarded by the NSF for innovation projects related to the application and innovation of nanotechnology for chemistry and the chemical industry.

- Top Trends in Nanotechnology for the ChemPlast Industry

As we can see in the graph below, this is a topic that is losing momentum or plateauing. However, we can see a shift in the trend in 2018.

While the majority of the organizations active on this topic were Universities, in 2018 this percentage is shifting and growing towards SMEs, which indicates this technology is getting closer to market.

Part of this shift is due to the practical work many Universities have carried through in the form of grants and projects for the development of this technology.

For example, RAPID grant was awarded by the NSF to the University of Puerto Rico to manufacture bioinspired plasmonic nanoarrays for biosensing and trace chemical detection. They seek to improve the current understanding of how nanomaterials interact with bioactive agents at the liquid/solid interface.

In a similar path, the University of Sheffield has received a grant from GTR’s Agency to explore the design and green manufacturing of functional nanomaterials. They aim to apply bioinspired routes to deliver sustainable (green), low cost and scalable technologies for manufacturing high value functional nanomaterials.

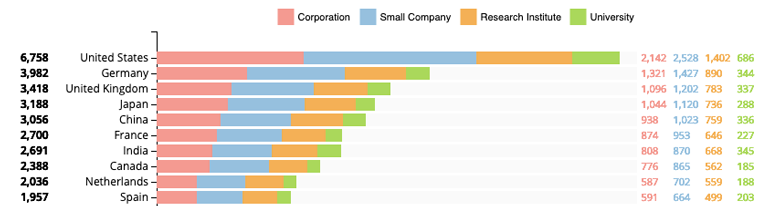

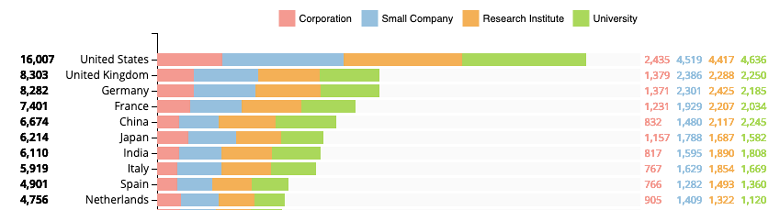

- Leading countries in Nanotechnology for the ChemPlast Industry

Finally, when analyzing the most active countries worldwide in this technology, the USA, Europe and East Asia take the lead, as expected.

In this case, it’s interesting to see how the organizations types are balanced through the leading countries, and, more or less, 50% of them belong to academia and 50% belong to private companies.

Here, a perfect example of the collaboration between different countries and between different organizations’ types is ELENA Project, a grant awarded by the European Commission that aims to develop low energy electron-driven chemistry for the advantage of emerging nanofabrication methods, as well as the training of a new generation of European scientists with a profound understanding of the physics and chemistry behind these processes.

2. Blockchain

It is surprising to see that the application of blockchain to the Chemical and Plastics industries is a topic where there is few related literature, barely 300 records have been issued since 2010.

Half of those records have been published in 2018, 97% of the total belong to industrial literature (specialized news, trademarks and patent applications), and three quarters of all records have been issued by companies (rather than academia).

- Key Players in Blockchain for the ChemPlast Industry

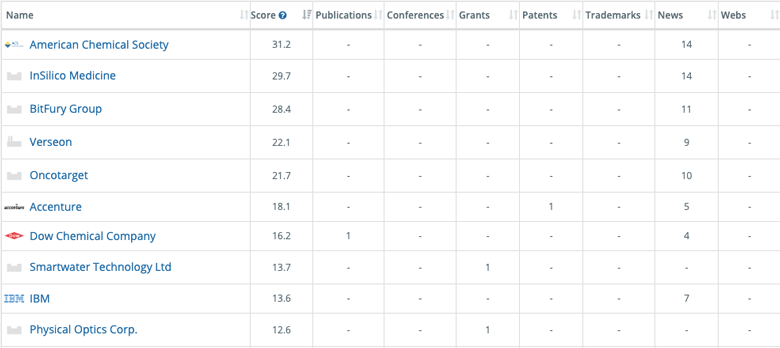

When looking at the aggregated set of records Linknovate has collected for the organizations worldwide applying blockchain technology to the Chemicals and Plastics Industries, 73% of them are companies (SMEs and Corporations) and the rest, 27%, belong to Academia (Universities and Research Labs).

For the top 10 organizations worldwide working in this topic, the percentages vary towards the private sector. No organization belong to academia, four are corporations, five are SMEs, and one is a Society.

Insilico Medicine is the organization most mentioned in the news. Basically, they manage medical data permissions with blockchain technology. But in the chemical field, they operate Chemistry.AI, a platform intended to capture the tacit knowledge of medicinal chemists.

For its part, Accenture has a patent application that involves chemical identities. It is a process that secures product identification and verification via blockchain technology and chemical identities to track and locates the shipping at all times.

- Top Trends in Blockchain for the ChemPlast Industry

When it comes to the trends within the applications of Blockchain technology for the Chemicals and Plastics Industries, we can see that main topics revolve around water treatment and chemical equipment for big companies.

In this regard, Smartwater Technology has received a grant from Innovative UK program to develop their smart water technology for tracing liquids. The aim is to ensure the ethical disposal of waste by tracing the whole process with blockchain technology.

And in China, HEPU Technology Development has a patent application for a blockchain-based carbon trading system that relates to the technical field of greenhouse gas monitoring and block chains.

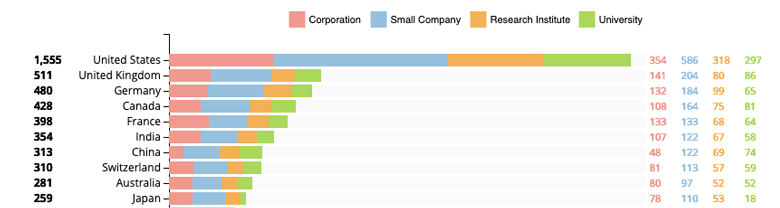

- Leading countries in Blockchain for the ChemPlast Industry

Regarding the most active countries applying blockchain technology for the Chemicals and Plastics industries, we can see that the United States is the clear leader, tripling the following country in line, the UK.

From the USA comes this related initiative launched by Mathelin Bay Associates. They have launched PlastiTrail.com, a blockchain-enabled global plastics marketplace to break down some of the current barriers preventing potential buyers and sellers of plastics resins, plastic compounds and plastic scrap from locating and contracting with trustworthy trading partners in their own country or in foreign markets.

In a similar line, Blockchain Development Company has launched the Plastic-Offset Scheme through its RecycleToCoin project. They use blockchain technology to purchase tokens that offset the amount of plastic consumed by an organization or individual.

3. 5G

The fifth generation of mobile communication networks, 5G, will bring faster, more reliable connections for users and will also provide the extra bandwidth needed to create the Internet of Things, a network that links not just phones and computers but also robots, cars, and all manner of sensor-equipped consumer products and infrastructure.

For its application in the chemical and plastic industries, it is projected it will allow edge communications between the machines of the facilities, as well as access to sensors data in real time, with the advantages it has in predictive maintenance and production.

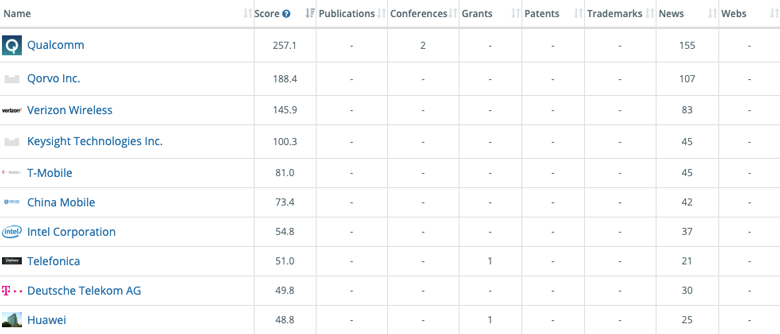

- Key Players in 5G for the ChemPlast Industry

Qualcomm is working on linear power amplifiers for 5G phased arrays for a different range of frequencies up to 26GHz. They work towards a clear goal: the deployment of gigabit-per-second mm-Wave technology by 2020. Besides, they’re collaborating with Keysight Technologies to simplify Gigabit LTE Innovation and achieve 2Gbps download speeds.

For its part, Huawei, via its Irish subsidiary is participating in 5GTANGO European Project, that proposes an integrated vendor-independent platform where the outcome of the development kit is automatically tested and validated in the Store for their posterior deployment with a customizable orchestrator compatible with common existing Virtual Infrastructure Managers (VIM) and SDN controllers in the market.

And Qorvo is helping to define 5G standards. They have recently introduced five new power amplifiers and front-end modules for massive MIMO and 5G base stations. These efficient, small-size modules support all frequency bands used for pre-5G and 5G architectures, from 3GHz to 39GHz, and this year have entered high-volume production.

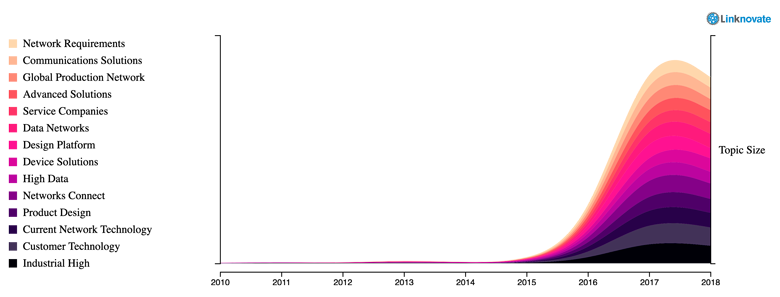

- Trends in 5G for the ChemPlast Industry

Trends within 5G technology applied to the Chemical and Plastics Industries are mostly related to data networks and platforms to improve (or speed up) network communications.

In this regard, Ommic is an interesting French SME that has received four European Projects for developing this technology. One of the most recent ones, SERENA Project, has the objective of scaling the functional performance of mm-wave beam-steering systems in terms of improved output power and efficiency, reduced form factor, increased data rate, and increased affordability.

There’s another interesting European project is Clear 5G, a consortium of 10 organizations that are working together to design, develop, validate, and demonstrate an integrated convergent wireless network for Machine Type and Mission Critical Communication (MTC/MCC) services for Factories of the Future.

Some companies part of the consortium are the University of Surrey, Adlink, TNO, or the French Atomic Energy Commission.

- Leading countries in 5G for the ChemPlast Industry

As expected, when it comes to the leading countries applying 5G technology to the Chemical and Plastics industries, they are economic powers like the USA, Europe, and China and India.

Using Linknovate platform, we have found some interesting examples of companies further developing this technology.

Quobis is a Spanish organization that is also participating in 5G Tango project alongside with other Spanish bigger companies like Atos and Telefonica. They develop carrier-class web-based communication tools for companies.

Also a participant from 5G Tango, Alcatel has two related patent applications for this topic. In these patents, Alcatel focuses in privacy and user identification and authorization, which can be applied to manufacturing facilities and supported with 5G networks.